News & Trends

What to Look for in a Green Label

Sustainable products have become a big seller – in all sectors. Green labels wherever you look: food, textiles, cosmetics. Sustainable investments have also entered the mainstream. But not everything that hides behind the green label is actually green. So, how can we safely navigate through the sustainability jungle without falling into the greenwashing trap?

Do Sustainable Investments Generate Returns?

Over the last 10 years, sustainable investments have performed better than traditional ones. The chart below shows the price development of the MSCI World (grey) broad world equity index compared to the MSCI World SRI (top 25 percent of sustainable companies; green). Expressed in figures, the MSCI World SRI clearly outperforms the world equity index by around 25 percent.

Looking back over the past 12 months, sustainable indices have also kept pace with the world equity index. The war in Europe and the associated energy crisis triggered a short-term revival of fossil fuels on the stock markets, a development from which sustainable indices did not benefit. However, renewable energies such as wind and solar also increased in value as market participants were made aware of the urgent need for an energy transition.

A Proliferation of Sustainability Ratings

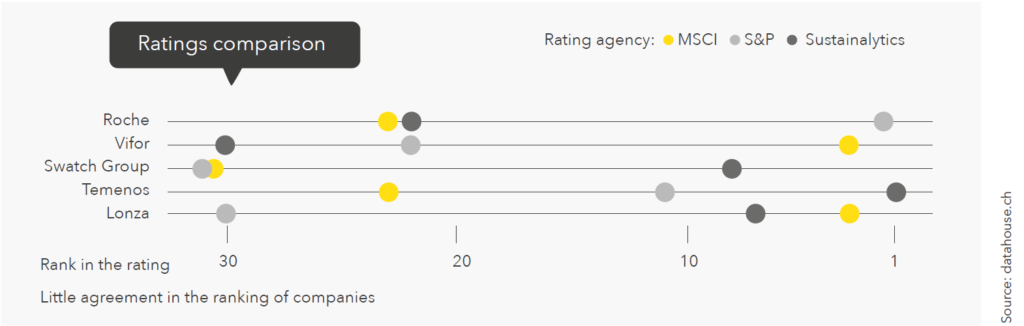

Sustainable investments have become an integral part of the financial world. In addition to pension funds and insurance companies, more and more private investors are now also thinking twice about in what companies and sectors they invest their money. The boom in these financial products has been huge in recent years, which has led to a proliferation of labels that is even difficult for professionals to navigate. The main problem is that there is no universal definition of sustainability. So it is measured and labelled to suit agendas rather than environmental concerns, which often leads to inconsistencies, omissions and ambiguities. For example, political lobbying is watering down the taxonomy by having nuclear energy and natural gas now also rated as “green”. The frequently applied “best in class” approach also does not provide an absolute view of things in its conventional form, but also brings companies from less sustainable sectors into the portfolio – the best of the worst, so to speak. ESG ratings can also cause confusion, as they only make risk statements about companies and each rating agency follows its own approach, thus arriving at completely different assessments of the same company (see chart below). The subjective weighting of the criteria can lead to a company being rated differently.

However, the “confusion”, especially with ESG ratings, is not all bad: they can be used purposefully as long as we know the specifics of their methods. If applied in this way, they are helpful in assessing an investment’s risks. However, if you want to achieve a positive impact for the future with an investment, you should not use ESG ratings as the sole criterion when choosing stocks. They are not suitable for identifying companies that make a special contribution to solving a specific problem such as climate change. This requires a tailor-made approach, like the one we use at Globalance with our footprint method.

Investment in Transformation or in Leaders?

Even though both approaches have something to be said for them, we favour investing in leaders – or in our words: in “futuremovers”. Companies organised in this way offer more return potential through a strong strategic focus on promising solutions and technologies.

However, we do not understand “leaders” in the old familiar sense of excluding companies from less sustainable sectors. With the aforementioned “best in class” approach, which selects the “best” company from each sector in terms of sustainability, you also bring an increased rating risk into the portfolio along with companies from sectors such as oil or mining. New legislation, future environmental taxes or the technological disruption of outdated business models may have a negative impact on these assets in the future.

As an investor, you should not invest in the successes of the past, but in the future. This future will belong to companies that successfully respond to global megatrends and develop solutions for global challenges such as urbanisation, digitisation or scarcity of resources. They are replacing outdated business models and at the same time achieving a positive footprint using innovative concepts. These may be large companies on the one hand, but are also increasingly medium-sized, dynamic companies with a focused strategy.

Of course, we also need a transformation of companies that are still “sitting” on old technologies, especially as these often hold large market shares at present. Transforming these companies will have a significant effect. However, certain conditions must be met for this: the company must pursue serious and verifiable goals, they must be consistently and strictly implemented, and the market must recognise its new position. Transformation therefore tends to be less interesting for investors because success is associated with greater uncertainty. But companies and assets can quickly seem enticing as an investment under the pretext of transformation. So investors need to look very carefully to ensure that they are not being “greenwashed”.

THE SUSTAINABILITY CHECK

Five questions to ask your bank:

- What percentage of your total investments are sustainable?

- Why do you continue to offer predominantly non-sustainable investments?

- Which Swiss companies have no place in a sustainable fund?

- Is the sustainability of investments also disclosed in the investment report?

- Are bonuses of the management linked to the bank’s sustainability goals?

For more insights on megatrends, please find the latest edition of our magazine ”futuremover”.