Wealth Management

Globalance Investment Solutions

Wealth management with Globalance enables private clients, foundations, family offices and B2B clients to invest successfully in forward-looking companies that solve global challenges and shape a positive future. Implementation in the form of an individual mandate is customised to your personal investment profile. Choose between a pure equity mandate or three multi-asset class solutions (each in CHF, EUR and USD).

«Basis»-Mandate

– Conservative risk profile

– Preservation of capital

– Security needs prevail

– Low potential returns

«Balance»-Mandate

Balanced risk profile –

Real preservation of capital –

Balanced security and risk needs –

Medium return potential –

«Chance»-Mandate

– Opportunity-oriented risk profile

– Long-term growth through current income and capital gains

– High return opportunities in the medium and long term

«Equities»-Mandate

High risk profile –

Long-term increase of assets, 100% equities –

Highest return opportunities in the long term –

Globalance investment strategy

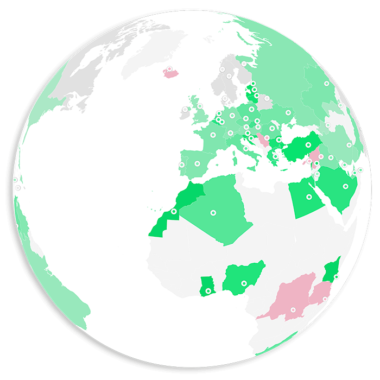

The sustainable and broadly diversified Globalance portfolios are based on three central pillars – the Globalance Footprint & Climate, global megatrends and financial quality. Only if an investment fulfils our criteria in all three areas is it suitable for a Globalance portfolio. In a structured process, around 100 core and future-mover stocks are selected from 45,000 listed companies worldwide.

«Globalance Bank, which has dedicated itself to the topics of megatrends and sustainability, has been showing for several years that things can be done differently – much better.»

Conclusion of the renowned FUCHS | RICHTER Prüfinstanz

Family Offices

Wealth preservation and growth – For our planet, for our children, for our future.

The future is yours – contact us now

Kontaktformular EN

"*" indicates required fields

Experience Globalance

Be inspired by the latest articles on futuremovers and megatrends or visit us at one of our next events.

The future in your letterbox

The Futuremover – the magazine for future-oriented investments.

Globalance community

Find out today what moves the world of tomorrow. You are warmly invited.