News & Trends

Globalance Investment Perspectives – Outlook for the second half of 2025

Global capital flows in transition

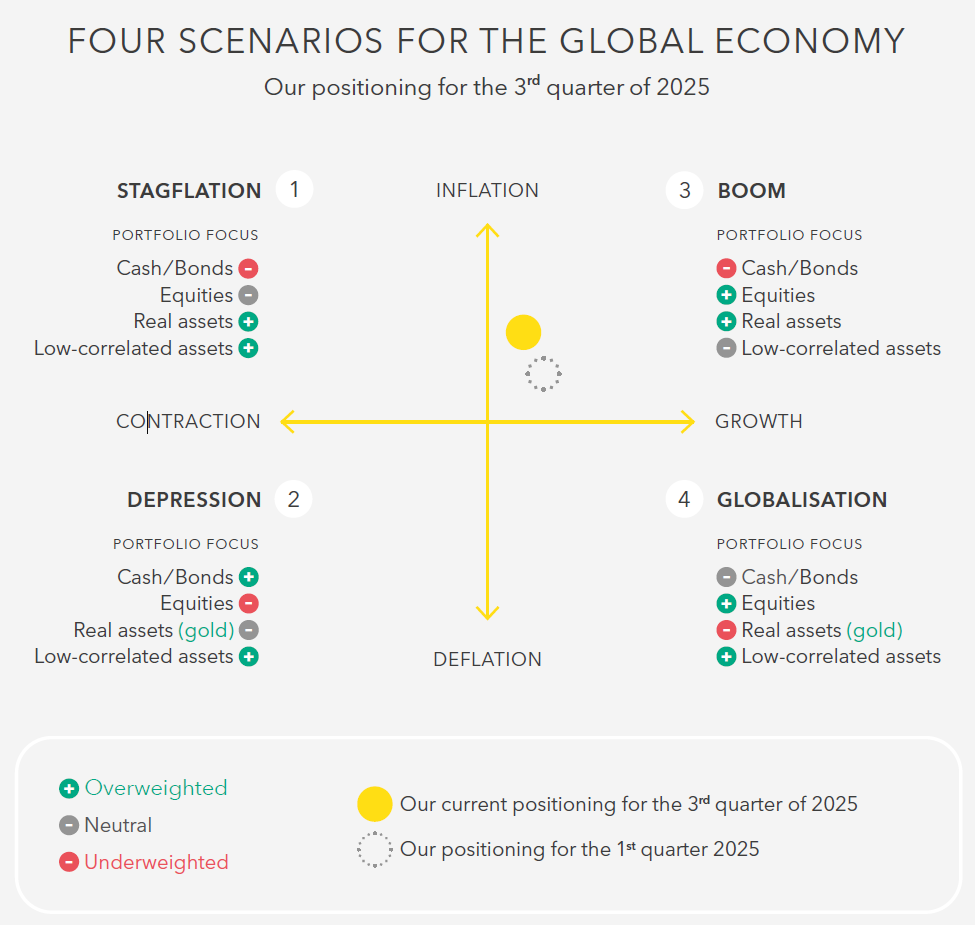

The US is increasingly losing its role as the sole growth engine of the global economy, and we therefore expect a slowdown in economic momentum in the second half of 2025. In our baseline scenario, Donald Trump’s tough rhetoric on tariffs remains largely symbolic, but the negotiations triggered by it are proving challenging and have had little effect to date. Although there are increasing signs of improvement, we expect the actual US tariffs to be higher than at the beginning of the year, and the economic turmoil caused by “Liberation Day” is leaving a noticeable impact. Disappointing economic data in the coming months therefore seems likely.

In view of inflationary pressure from tariffs, the US Federal Reserve is taking a cautious approach to further interest rate cuts, although we expect the US key interest rate to be slightly lower by the end of the year. Companies remain cautious about capital spending and new hires, which is further dampening growth.

Europe set for upswing, Asia stabilising

Europe is entering the second half of the year with a growth-friendly reform agenda. We expect investment spending and several interest rate cuts by the end of the year. In Switzerland, there is a risk that the Swiss National Bank will lower interest rates to negative levels in response to deflation. In Asia, particularly in China, trade issues remain a source of uncertainty, while fiscal policy measures are having a stabilising effect.

Robust asset allocation is gaining importance

The market environment will remain challenging in the second half of the year too, making broad diversification and forward-looking asset allocation even more important. We consistently aim for a balanced allocation across asset classes, regions and sectors, focusing on companies with robust business models and stable earnings, even in periods of slowing growth.

Investment strategy to remain global

Thanks to our globally oriented investment philosophy, we draw on a broad investment universe and invest worldwide in the most innovative and future-proof companies. Future topics such as digitisation and artificial intelligence (AI) remain firmly anchored in the US. At the same time, we continue to invest selectively to European and Asian equities, for example in megatrends such as health care and the knowledge society. We are thereby responding to changing capital flows and regional growth trends.

Investment policy for Q3/2025

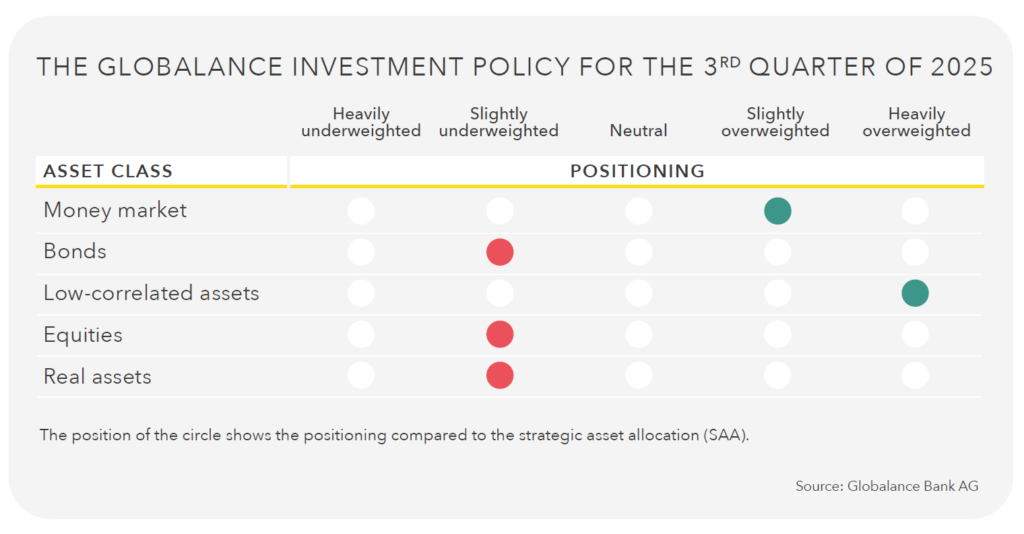

In view of current developments and possible scenarios, we reduced risks and strengthened our resilience in the second quarter and are maintaining this positioning for the third quarter. Among other things, this means slightly underweighting equities due to higher valuations following the reversal rally from the April lows and ongoing trade policy uncertainty.

The chart shows our positioning in the first quarter of 2025, focused on stable growth and declining inflation. The geopolitical situation under President Trump has fundamentally changed the economic outlook. We now expect global growth to slow, accompanied by a moderate rise in inflation, driven primarily by the US. Europe and Asia are showing opposite trends.

Bonds: Caution with US bonds — opportunities in Europe

The rising US national debt is weighing on the long-term outlook for US government bonds. We take a much more positive view of European government bonds: solid government budgets and potential trade shifts away from the US are fuelling deflationary trends and falling interest rates. Here, we prefer high-quality European government bonds with medium maturities — ideally via green bonds. We do not consider global corporate bonds, especially those with lower ratings, to be attractive. The risk premiums are hardly commensurate with the risk of an economic downturn. Emerging market bonds offer attractive returns and valuable diversification.

Low-correlated assets:an anchor in uncertain times

Our investments in insurance linked securities, microfinance and premium strategies remain broadly diversified and overweighted. This remains sensible given their stable earnings profiles and low sensitivity to interest rate and equity markets.

Equities: global opportunities from megatrends After a very volatile first half of the year, global stock markets are currently trading just below their previous highs. Higher tariffs continue to weigh on corporate profits, but investor-friendly measures such as interest rate cuts and deregulation could counteract this in the second half of 2025. However, ongoing uncertainty and market fluctuations are still likely.

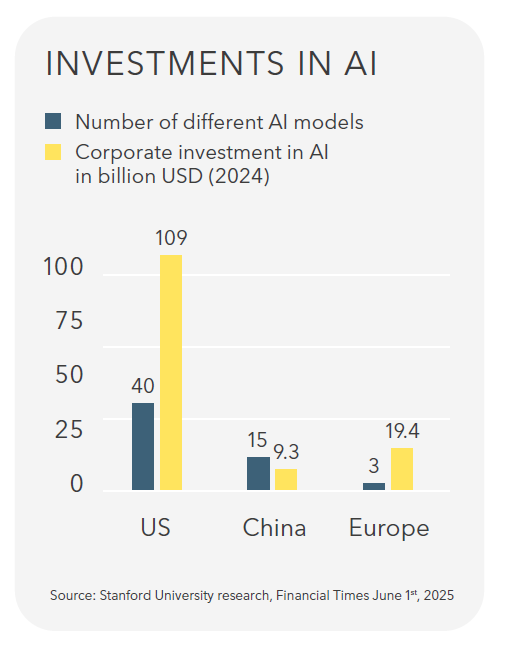

One thing is clear: companies with sustainable business models and technologies — such as automation technology or energy-efficient construction — are holding their own in uncertain times thanks to stronger pricing power and product differentiation. When it comes to the megatrend of digitisation, we continue to focus on innovative US companies. We are convinced that AI increases productivity across all industries. The leading role of the US is clearly evident in the level of investment and the large number of AI models developed.

Real assets: gold as a crisis-proof building block

In the area of real assets, we are maintaining our 5 % allocation to gold. Furthermore, private market investments and green infrastructure offer attractive returns. Commodities are not included in our portfolios.

Conclusion

US sees growth slowdown, while Europe shows slightly more momentum thanks to investment programmes

Portfolios that are more robust and adapted to the new world order thanks to risk reduction in equities, profit-taking in bonds, an increase in low-correlated assets

Opportunities in European government-issued green bonds

High gold allocation as a risk buffer

Global equities with a focus on megatrends such as digitisation and the addition of European and Asian futuremover equities in growth areas such as health care, urbanisation and the knowledge society

Interview

Opportunities in a world

in transition

Susanne Kundert, Head of Investments, on future opportunities in a challenging environment

Susanne Kundert has been a member of the Executive Board of Globalance Bank since April 2024 and is Head of Investments. She has more than 20 years of experience in asset management, including 15 years in the area of sustainable investment solutions.

What do developments in the US mean from an investment perspective? What has changed in your investment strategy in recent months?

The political change of course in the US led to geopolitical uncertainty, rising inflation expectations and capital outflows. Compared to the first quarter, our current outlook is more cautious: Trump’s tariff policy is fuelling uncertainty, dampening consumer confidence, and holding back business investment. Even before “Liberation Day”, we therefore reduced our equity exposure slightly and increased the robustness of our portfolios by purchasing premium strategies and gold.

What does the geopolitical change mean for investors in the medium and longer term?

Geopolitical fragmentation, trade conflicts and the decline in international cooperation are reducing global efficiency and shifting financial flows. Confidence in the US dollar and US government bonds is waning, partly due to growing US government debt. Capital is increasingly seeking more stable regions. The following rule applies for investors: global diversification, currency hedging, and alternatives such as gold or European green bonds with medium-term maturities strengthen their portfolio’s robustness.

What are the most exciting topics for the future, and how is the portfolio addressing them?

Demographic change is making health care a structural growth issue — largely independent of economic cycles or trade policy developments. Targeted investments are being made in areas such as diabetes, obesity and personalised medicine. Innovative therapies for age-related diseases are particularly in demand, for example Vertex Pharmaceuticals, a biotechnology company specialising in gene therapy and rare diseases.

In the knowledge society, online education is becoming increasingly important due to ongoing digitisation and is establishing itself as an attractive alternative to in-person learning. Stride, Inc. is a technology-driven education company offering AI-powered, personalised learning solutions. It is seeing above-average growth — and is unaffected by tarrifs.

How can digitisation and AI have a positive impact on our planet?

There are various application examples: In precision agriculture, AI drones analyse fields and enable targeted cultivation — with up to 40 % less pesticides, 30 % less water and 20 % higher yields. AI also optimises energy consumption in buildings, such as in the Empire State Building, which has reduced its energy requirements by 38 %. Artificial intelligence will accelerate decarbonisation and is an interesting investment theme.

Should one invest in China, and if so, in what assets?

From an innovation perspective, China offers many interesting opportunities. However, we often receive too little transparency to assess an investment in the same way as in other global economies. Non-financial data is rarely published, or there is too close a connection to the Chinese government, which poses a risk. That is why we are very selective in China and invest in companies with future-oriented themes such as electric mobility (BYD) and digitisation.

What consequences will Trump’s policies have for renewable energies?

Donald Trump wants to scrap key parts of the Inflation Reduction Act investment programme, such as tax breaks for electric cars and subsidies for renewable energies. However, we see that many companies are planning beyond Trump’s term in office. They are preparing for further decarbonisation and securing long-term electricity contracts, as are the major technology companies, for example. However, they appear more reserved in public, for example by not communicating specific climate targets.

Be part of the solution and stay informed with the Futuremover.

Subscribe now and shape the future!

Magazin abonnieren EN

"*" indicates required fields