News & Trends

Globalance Investment Perspectives – Review of the first half of 2025

A new world order

A fundamental political shift in the United States has increased geopolitical tensions and structural challenges, such as the energy transition and fragile supply chains. All this shaped the transition to a new world order.

Donald Trump’s return to office and his new political priorities have accelerated the transition to a new era: after eight decades of globalisation, there is a growing trend towards protectionism. Trump’s tariffs are merely the visible tool of a broader strategy that responds to the growing challenge posed by China’s rise and the threat to US supremacy. Washington is increasingly withdrawing from its role as global patron. Europe, on the other hand, in view of the new uncertainties, has declared security a national priority and is investing accordingly in its defence capabilities.

US tariff policy fuelled tension and weighed on growth

The introduction of comprehensive tariffs aims to enforce fiscal discipline and economic isolation — with noticeable negative consequences for consumption and corporate investment.

In Europe, governments responded with more expansionary fiscal policy measures. Germany, for example, relaxed its debt brake in favour of defence and infrastructure spending. In China, economic growth remained subdued, and the deflationary trend continued. Trade diversion as a result of US tariffs slowed export momentum, which had previously been a key driver of growth for the Chinese economy.

Despite robust corporate earnings, ongoing trade policy uncertainties clouded the outlook for companies. Global growth is at risk of losing momentum, which was not sufficiently reflected in risk assets in the first half of 2025.

Central banks with different interest rate cutting dynamics

The increase in effective US tariffs exacerbated structural inflation risks and jeopardised the easing of consumer prices that had been achieved previously. Against this backdrop, the US Federal Reserve remained cautious with interest rate cuts, not least because of a robust labour market. In the eurozone, however, inflation fell below the target rate of 2 %, indicating stable price developments. This gave the European Central Bank (ECB) room to cut interest rates several times to help the economy grow. European stock markets responded to this move with gains. Falling consumer prices in Switzerland also prompted the Swiss National Bank (SNB) to cut its key interest rate in order to ensure price stability and weaken the franc at the same time. These monetary policy measures provided additional tailwind for the Swiss stock market.

Global capital flows have shifted

The aggressive US tariff policy has shaken confidence in the reliability of American economic policy. Despite temporary signs of easing, the structural effects remain clearly noticeable: increased market volatility, capital outflows and a reduced appeal of the US dollar as a safe haven. The strategic hedging of the US dollar paid off in our portfolios. This loss of trust led to increased capital inflows into Europe and emerging markets, which is reflected in the relative outperformance of these regions compared with the US equity market. At the same time, US government bonds have been under pressure since April, weighed down by the growing budget deficit and increasing political uncertainty.

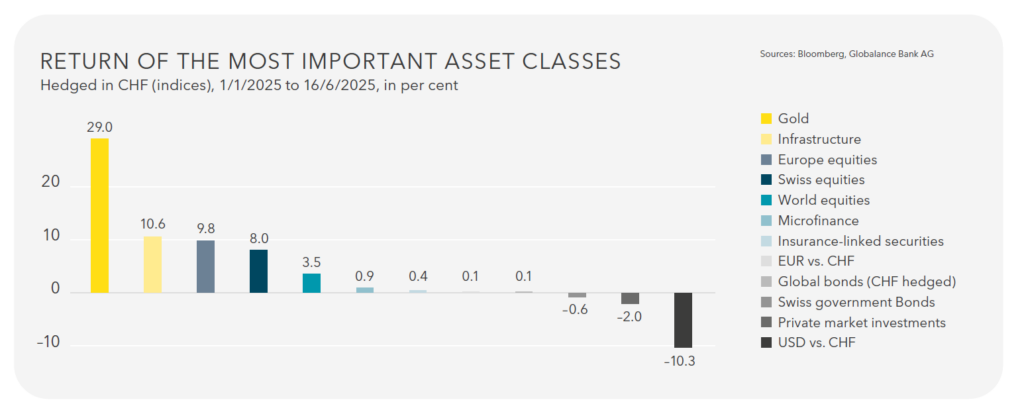

High market volatility necessitated robust portfolio construction

The first half of 2025 saw the usual negative correlation between equities and bonds falter and both recorded losses in April, for example. In this environment, gold once again confirmed its role as a safe haven asset, supported by increased central bank purchases from emerging markets. Low-correlated assets such as insurance linked securities and microfinance proved to be stable portfolio components.

The Globalance portfolios’ focus on future topics has proven its worth as companies in the megatrends of decarbonisation and urbanisation delivered convincing returns. In particular, shares of mid-capitalised futuremovers performed above average over the course of the year. Investments in broadly diversified infrastructure also benefited from favourable financing conditions and political support in the eurozone, with positive effects on returns.

The first half of 2025 in brief

The new world order, characterised by the protectionist US tariff policy, had a dampening effect on consumption, capital spending, and global growth. Inflation expectations rose in the US, while Europe achieved price stability.

Loss of confidence in US assets led to increased capital flows to Europe and emerging markets, explaining their strength relative to the US stock market.

The Globalance portfolios delivered robust returns thanks to diversification with low-correlated assets and a high gold allocation.

The strategic hedging of the US dollar in the portfolios has proven worthwhile.

Future topics such as digitisation and decarbonisation have strengthened the companies’ pricing power, which is a key advantage, especially in a challenging environment with stagflationary tendencies.

Megatrends in the first half of 2025

Companies in the “New mobility” megatrend outside of China are currently suffering from export restrictions on rare earth elements and magnets. This affects electric and hybrid vehicles more than conventional cars. Our portfolio components are located in China and across Asia, and benefit from political support programmes and government subsidies, such as our futuremover BYD.

Companies in the “Consumer society” megatrend, particularly in the area of basic necessities such as organic food or household goods, showed a solid performance. This is because everyday products remain in demand even with a fluctuating economy or geopolitical tension, so these companies offer stability in uncertain times. At the same time, many of these companies are able to pass on price increases and maintain their margins. Unilever or Sprouts Farmers Market are illustrative examples in our portfolio as they have proven themselves as defensive anchors for investors.

Companies in the “Urbanisation” megatrend benefited from the global trend towards living in cities and the rising demand for intelligent energy-efficient infrastructure. Falling interest rates encouraged investment in construction, energy and mobility — an environment in which urban solution providers can grow structurally. This year, related companies in our portfolios such as American Water Works or Trane Technologies have generated an above-average performance.

The performance of companies in the “Digitisation” megatrend has recently been weaker because they were highly valued following the AI (artificial intelligence) upswing in 2024. Donald Trump’s new tariffs in April 2025 fuelled additional uncertainty, increased costs and dampened expectations — a combination that put pressure on share prices. Nevertheless, the long-term outlook remains positive as the digital transformation is unstoppable, from automation through the cloud and AI to cybersecurity. Companies that enable or efficiently utilise these technologies are needed in all sectors.

Cybersecurity on the rise:

Threat situation and market opportunities

Cybersecurity will remain a fast-growing segment within the digitisation megatrend in 2025. Technological progress, improved connectivity and the increase in digital commerce are increasing cyber risks. AI further intensifies these threats but also has the potential to improve cybersecurity measures. In 2023 alone, the damage caused by cybercrime amounted to over eight trillion Swiss francs globally. If cybercrime were measured in the same way as a country’s gross domestic product (GDP), it would be equivalent to the volume of the world’s third-largest economy after the USA and China.

In view of increasing threats from cyberspace, the relevance of digital security solutions is growing, and with it the economic importance of the corresponding companies. From January to May 2025, the MSCI Cybersecurity Index recorded an increase of around 18 percent. This means that the cybersecurity sector is once again outperforming the wider market. Companies that specialise in AI-based security solutions, cloud infrastructure protection and proactive threat prevention are particularly in demand, including our futuremover company Palo Alto Networks.

Macro environment: two threat lines, one strong impulse

The reasons for this development are complex. However, it is primarily fuelled by a combination of technological vulnerability, geopolitical escalation and growing regulatory pressure.

1. Attacks on the private sector continue to increase

According to the Allianz Risk Barometer 2025 cyber incidents are the biggest business risk worldwide for the fourth year in a row. The biggest concerns are data leaks, ransomware attacks and increasing losses from AI-driven attacks.

2. State cyber operations are escalating

The WEF Global Cybersecurity Outlook 2025 emphasises that cyberspace has become an area of global geopolitical tension. Over 70 percent of managers expect cyberattacks in the near future and almost half consider themselves to be ill-prepared. State-controlled hacker groups that attack critical infrastructure, elections and key technologies pose a particular threat.

3. Regulatory tailwind

At the same time, new legal requirements in the EU and the USA are putting pressure on investment. This is leading to billions in new expenditure on audits, security architectures and emergency response teams, for example.

We expect the cybersecurity industry to continue to benefit from the environment in 2025, because the real threat situation is intensifying, the political will for digital defence is growing and companies around the world are investing to meet legal requirements and minimise reputational risks.

Be part of the solution and stay informed with the Futuremover.

Subscribe now and shape the future!

Magazin abonnieren EN

"*" indicates required fields