News & Trends

To invest in China – yes or no?

China’s regulators have unsettled investors in recent months with drastic regulatory intervention in the tech and education sectors. Against this backdrop, the question for investors is whether to invest in China, and if so, how.

Summary

In general, the tight control of its own population and treatment of minorities show what a power-centric path Beijing has taken.

Our assessment is that a commitment makes sense for investors under certain conditions. Most attractive features being economic growth, stock valuation and portfolio diversification effects.

Investors, however, should be extremely selective when choosing Chinese stocks. Corporate governance and the degree of state influence must be very much part of the assessment, as well as the three aspects of megatrend, footprint and financial quality.

We also recommend focusing on exposure via foreign companies with significant revenue shares in China to further mitigate potential unpredictability.

Unstoppable progress

We consider China’s long-term growth opportunities to be interesting. China is transforming itself into a technology leader with a strong domestic economy.

With a share of a little under 20% of global value added, China is the second largest economy – by the middle of the decade it is expected to replace the US as number 1. The Shanghai, Hong Kong and Shenzhen stock exchanges rank 3rd, 4th and 6th in terms of trading volumes in a global comparison – with a rapid upward trend.

Unpredictability yes, unrestricted no

China is showing that it puts the preservation of the Communist Party and its long-term plan above all else. This basic attitude is not new and the associated risk is commonly known.

China’s declared claim to leadership in Asia, however, provides a framework for state unpredictability. A basic level of confidence for investors and a stable currency are essential pillars China needs to observe.

Furthermore, not all sectors are equally affected. Chinese companies with listings abroad (e.g. American Depositary Receipts, or ADRs) and business models that run counter to the party’s political line are particularly exposed. For example, too strong entrepreneurial personalities, too open social media platforms or companies that make profits at the expense of the middle class.

Attractive features for investors

Due to economic growth, China’s share in global stock market indices will continue to increase in future. In the broad global equity index (MSCI World AC), its share today is just 7%, far below China’s real economic weight of 20%.

Valuations are also significantly lower by global standards: China’s price-to-earnings ratio is 16x – about half that of the US at 31x or India at 33x. This supports a selective market entry.

Another argument is the extremely low correlation of Chinese equities with other regions such as the US, Europe or Japan which offers very good diversification potential for investors.

Corporate Governance, Footprint and Party Line

Due to China’s political peculiarities, active stock selection is key.

Globalance focuses on equities or business models that bear up under the three aspects of megatrend exposure, footprint and financial quality. Corporate governance and the degree of state influence are a critical part of the assessment of Chinese companies. Our Globalance Footprint® also actively filters out companies that contribute to controlling and restricting civil rights.

Ultimately, it is necessary to assess to what extent a company might clash with the party’s political line. That is a complex matter, yet there are current indications. We find the least conflicts of interest in topics that also seem indispensable to the governing party: new mobility, digitisation, automation, renewable energy (Climate & Energy megatrend), smart building (Urbanisation megatrend) and resource efficiency (Resource Scarcity megatrend). Caution, on the other hand, seems to be called for in the topics of education (knowledge-based society), consumption and health & ageing.

Selective implementation in the portfolio

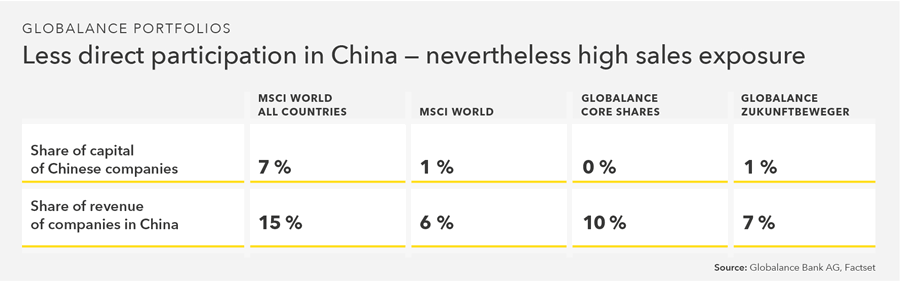

We consider a selective exposure to China as described above to be advisable. Due to political attributes, we favour an underweighting in direct Chinese holdings. Instead, we focus on foreign companies with significant revenue shares in China which might further mitigate possible unpredictability.