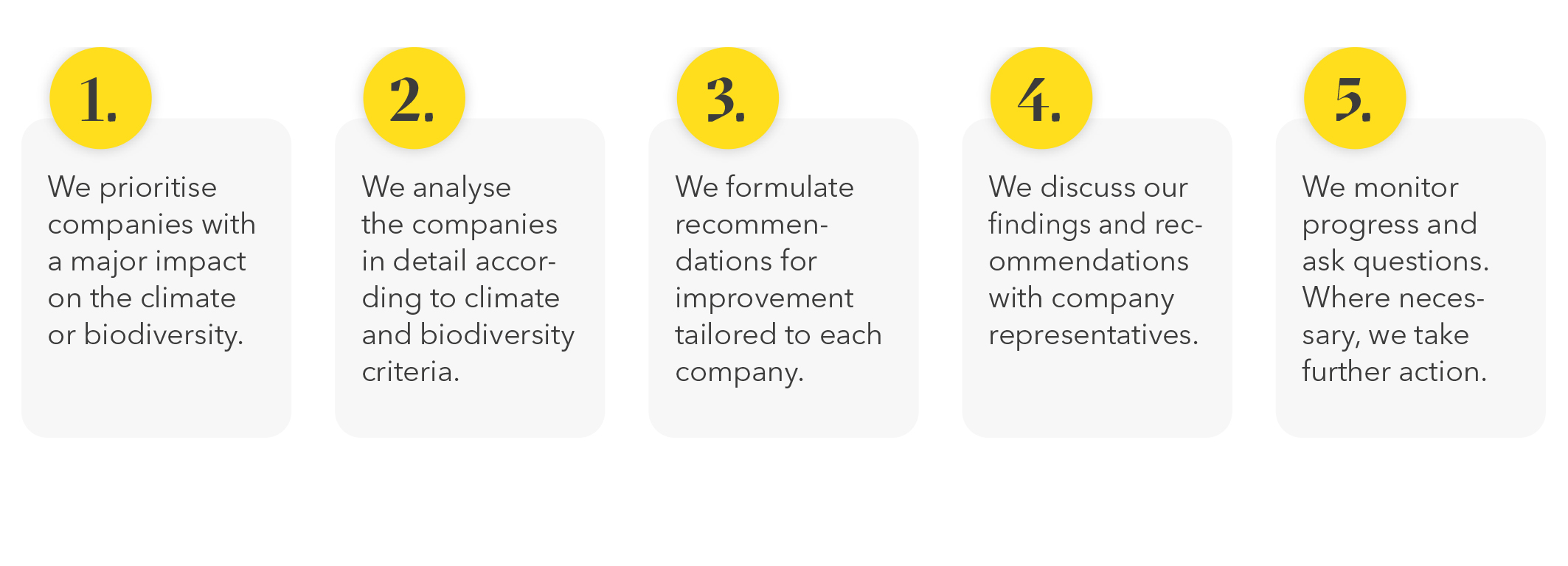

This is how we proceed

Shareholder Engagement

Shareholder engagement involves shareholders or asset managers entering into a direct dialogue with companies. The focus lies on challenges in the areas of governance, society and the environment. At Globalance, we conduct dialogues on the topics of climate, biodiversity and human rights.

Our Engagement in Five Steps

In our dialogues with our portfolio companies in 2025, we focused on two topics: climate and biodiversity.

• Climate: We analysed companies with a relevant impact on the climate on the basis of five criteria: greenhouse gas reporting, greenhouse gas reductions already achieved, greenhouse gas reduction targets, measures to reduce greenhouse gas emissions, climate governance.

• Biodiversity: We use our new biodiversity data from Iceberg Datalab, which considers the whole value chain of companies to identify the companies for which biodiversity loss is a relevant topic. Our recommendations focus on the use of resources, as this is where most companies have the greatest potential to operate in a more biodiversity-friendly manner

Criteria for our Climate-Analysis

Greenhouse Gas Reporting

- Are the relevant emissions published?

- Are the published emissions verified by a third party

Greenhouse Gas Reduction

- Has the company already achieved relevant emission reductions in the past?

Greenhouse Gas Reduction Targets

- Does the company have ambitious emission reduction targets?

- Are the relevant emission sources part of the targets?

Measures to Reduce Greenhouse Gas Emissions

- Are specific measures to achieve the announced targets published?

Climate Governance

- Is the topic of climate under the supervision of the Board of Directors?

- Is there a person with climate expertise on the Board of Directors?

- Is management remuneration linked to the communicated climate targets?

Our Escalation Steps

- Raising the matter with the board of directors

- Cooperating with other investors

- Voting against members of the board of directors (e.g. against the chairperson or members of the sustainability committee)

- Presenting the issue at the Annual General Meeting

- Submitting a shareholder proposal

- Divesting

Company Dialogue – Climate Case Studies

Since 2023, Globalance has been engaging in dialogue with Unilever as part of the Climate Action 100+ initiative.

During this period, the company has experienced significant change, including two CEO transitions and a strategic refocusing on core brands.

Globalance’s objective is to ensure that Unilever’s sustainability ambitions are not diluted despite these developments.

ASML vs. Applied Materials: Comparing Sustainable Executive Compensation

Globalance is engaged in dialogue with ASML and Applied Materials in the semiconductor industry, calling for the linkage of management compensation to sustainability targets.

While ASML has tied 20% of its long-term incentive program to sustainability-related metrics, Applied Materials is less advanced and transparent in this regard. Such incentive structures provide important insights into the credibility with which companies pursue their sustainability objectives.

Globalance also facilitates the exchange of best practices among the companies.

We analyse portfolio companies for their impact on the environment and health and write to the companies with tailored recommendations for improvement.